The Nippotica Way

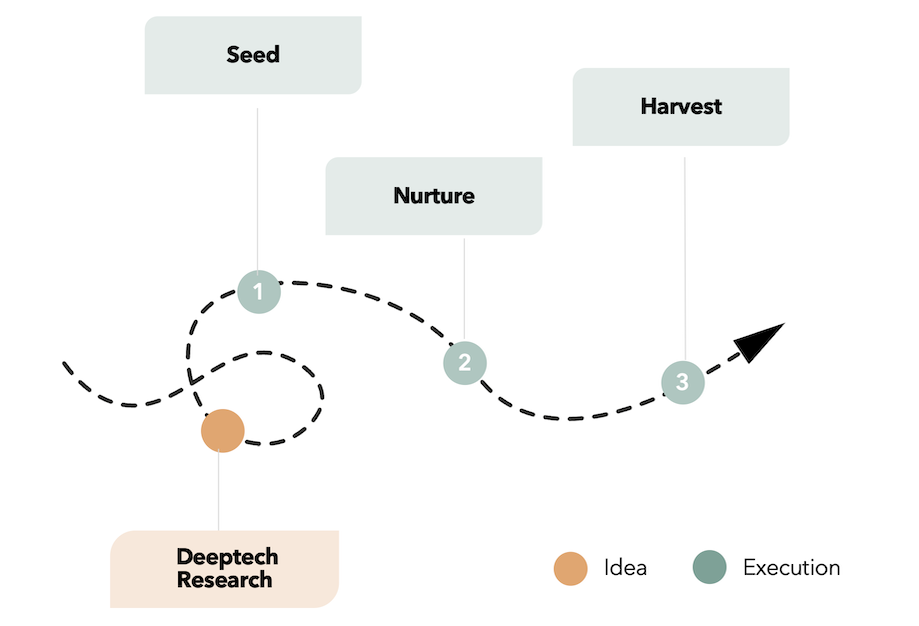

Simple, Clear Process for Commercializing Deeptech

Nippotica is a deeptech venture builder that turns advanced research into market-ready solutions. Each solution originates within Nippotica and is launched as an independent company once it demonstrates market traction and team readiness.

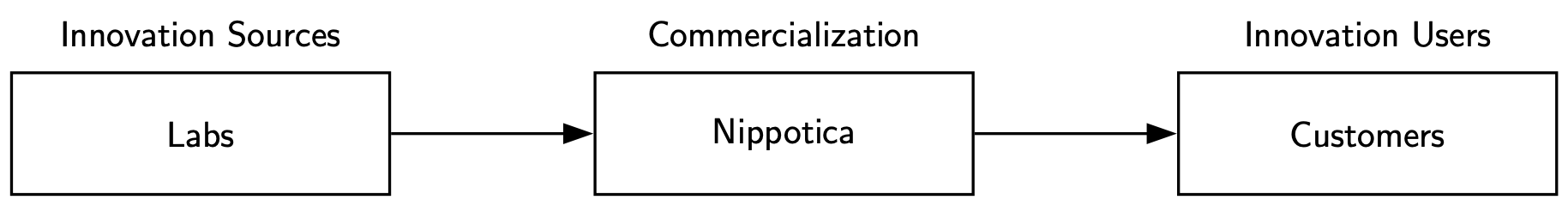

Commercializing Deeptech

Deeptech innovations emerge from years of research at universities, government labs, and global research initiatives. These breakthroughs—in AI, semiconductors, materials science, and more—fuel industries like fintech, smart manufacturing, and biotech.

From Labs to Markets

How Nippotica Commercializes Deeptech

Nippotica works closely with Japan’s top technical universities and their international research networks to stay at the forefront of this innovation. These partnerships give our startups access to advanced technologies and expert knowledge, forming a solid foundation for market entry.

Our model supports entrepreneurs in turning deep, research-based technologies into real businesses. By building on validated R&D, Nippotica’s ventures create unique, hard-to-replicate solutions that stand out in the market and deliver lasting competitive advantages.

Creating New Ventures

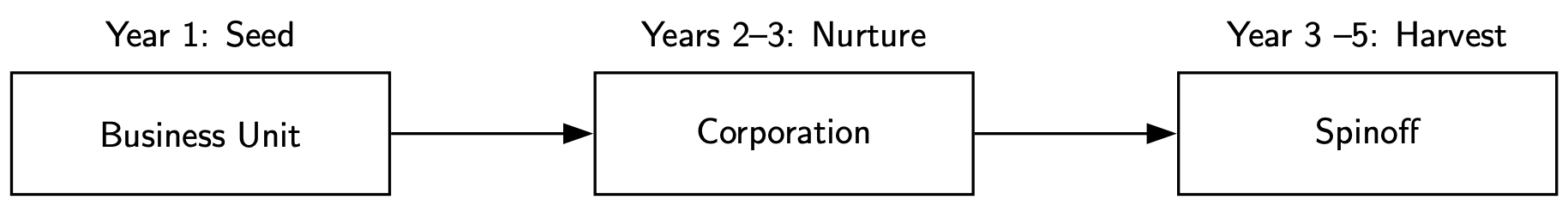

Nippotica takes a systematic approach to deeptech venture creation. Launching a business as a standalone company too early can mislead stakeholders by projecting a level of maturity the startup hasn’t yet earned. Describing a new team as a corporation can confuse customers and partners, creating unrealistic expectations around stability and capability.

Systematic Venture Creation

The Right Way to Build Ventures

Instead, new ventures begin as internal business units within Nippotica. These teams grow step by step, gaining independence through results—not rhetoric. The focus is on securing early customers, assembling a capable team, and delivering solutions that solve real problems. Progress is measured through signed contracts, strategic partnerships, and industry recognition.

When key milestones are reached, the venture becomes a fully owned subsidiary. This transition—from internal unit to independent entity—is grounded in actual performance. The goal is to build strong, self-sustaining companies, paving the way for future liquidity events that benefit all stakeholders involved.